A Lot of Things I learned from False Dawn, Part 2

Inside the Most Misunderstood Economic Program in U.S. History

Over the past few weeks, I have read George Selgin’s 2025 book False Dawn. The 384-page book is a deep dive into how the US recovered from the Great Depression and what role, if any, the New Deal played in that recovery (the book does not cover the other two R’s, relief or reform). In fact, according to Selgin, this is the first book focused on these two questions.

It’s a remarkable piece of work. The book is dense, meticulously researched, and relentlessly informative—hardly a page passes without an unfamiliar fact or a revisionist insight. Because there’s so much here, I’ll be splitting my discussion into three posts, one for each major section: “Groundwork”, “The New Deal’, and “After the New Deal”.

The AAA and NRA were the twin pillars of early New Deal Recovery efforts. The AAA’s goal was to boost farmers’ purchasing power by reducing their output, thereby raising prices. The economic theory behind this was that farmers had a higher marginal propensity to consume than non-farmers, so shifting funds to them would stimulate aggregate demand. This benefited southern and midwestern farmers, who tended to grow plant products, more than northeastern farmers, who raised livestock that depended on the feed grown by southern and midwestern farmers.

As for the other pillar, the NRA was intended to boost manufacturers’ revenues by limiting competition, while simultaneously raising workers’ wages to increase purchasing power. The NRA also established working condition requirements, maximum and minimum hours worked, and overtime wage rates. The economic theory here was that higher wages would increase purchasing power-- the so-called “high wage doctrine”. Ironically, FDR shared this view with Herbert Hoover, while John Maynard Keynes denounced it as a “technical fallacy”.

“The stimulation of output by increasing aggregate purchasing power is the right way to get prices up; and not the other way around.”

To promote NRA compliance, those who did were exempt from antitrust enforcement. Even after the NRA was struck down, through 1938, the DOJ declined to enforce antitrust laws on industries that honored the prior NRA codes. The change in 1938 was due to the appointment of Thurman Arnold as the United States Assistant Attorney General for the Antitrust Division.

The Home Owners’ Loan Corporation (HOLC) was created to both promote recovery and provide relief to homeowners. Its efforts refinanced over 1 million mortgages, including 200,000 it eventually foreclosed on. Mechanically, lenders could trade their bad mortgages for HOLC bonds. While long-term, amortizing mortgages were not typical before the Great Depression, HOLC refinanced existing balloon loans with 10- or 15-year amortizing loans. Given that there were roughly 1,000 foreclosures a day when FDR was inaugurated, this policy clearly provided relief, if nothing else.

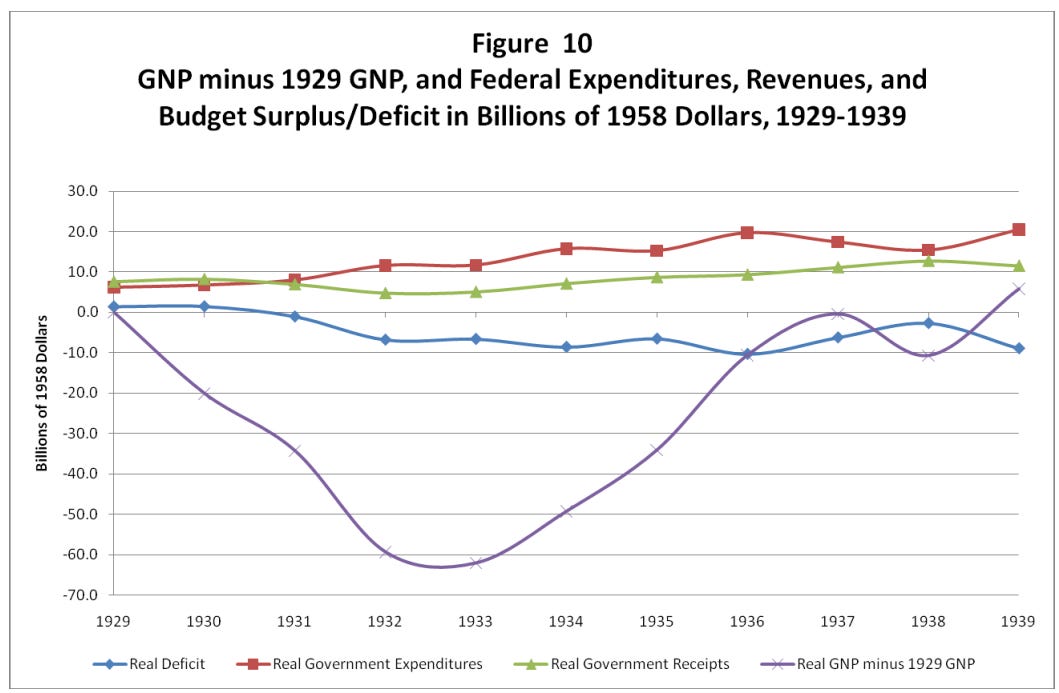

Contrary to popular opinion, the New Deal did not represent Keynesian expansion. For both the Hoover and Roosevelt administrations, while federal spending doubled, taxes increased roughly as much as spending did, leading only to “minuscule” deficits.

In fact, the largest New Deal deficit came in 1936 when Congress overrode FDR’s veto to pass veteran bonuses. Years earlier, FDR only signed $3.3 billion (a compromise from the $5 billion Congress originally sought) in Public Works Administration funding because it was attached to the NRA. Only the 1934, 1936, and 1939 deficits were larger than Hoover’s largest. Julian Zelizer has even described fiscal conservatism as a “key component” of the New Deal

“Despite the fairly good showing made in the recovery up to 1937, the fact is that neither before nor since had the administration pursued a really positive expansionist program” -Alvin Hansen, The American Keynes

Keynes was not well known in the United States until 1936, four years after the New Deal began. While FDR did have advisors —such as Frances Perkins, Harold Ickes, Harry Hopkins, and Marriner Eccles —who were advocates of fiscal expansion, there is little evidence that Keynes influenced any of them. Ironically, the only Roosevelt advisor linked to Keynes before 1936 was Felix Frankfurter, who is more associated with the Trustbusters.

Additionally, American economists such as Irving Fisher, Frank Knight, George Warren, William Foster, and Waddill Catchings likely had a greater influence on FDR and expansionary fiscal policy. For example, in January 1932, 31 economists sent a letter to Congress advocating for $5 billion in additional deficit spending. Going a step further, Ralph Hawtrey was likely a more influential British economist due to his 7-year stay at Harvard.

FDR “never… read anything Keynes wrote, except perhaps some newspaper pieces…” -Rexford Tugwell

While FDR and Keynes did meet once, it was only for an hour, and neither thought the meeting went well. FDR believed Keynes was arguing that he should do more of what he was already doing, and Keynes believed FDR should focus less on reform and more on recovery.

Roosevelt did not abandon his commitment to fiscal conservatism until 1937-1938, and the influence of Harry Hopkins. On April 14, 1938, FDR asked Congress for $3.75 billion for public works and relief, but, as a percent of GDP, this was smaller than the 1936 veterans bonus. This change of heart and corresponding increase in government spending lasted only one year.

Many readers of this blog are probably aware of the slander surrounding Herbert Hoover’s response to the Great Depression. But here are two additional factoids: First, when Hoover became President, he proposed the “Hoover Plan,” which would have deferred government construction until economic downturns. Second, under Hoover, spending on public works tripled in the first two years of the depression

Libertarian economist Robert Higgs has been a “famous” proponent of the “regime uncertainty” effects of the New Deal. In this view, he is an intellectual successor to Keynes.

“...no likelihood that business of its own initiative will invest in durable goods of sufficient scale [to end the Depression] for many months to come.” -JM Keynes in 1934

“Just because a boy wants to go to college is no reason why we should finance it” -FDR